CPS 491

Andrew Case

MB Investing

For this capstone, the project scope is to create server-side logic to parse data pulled from two third party locations, IEX and Alpha Vantage. These two sites hold reliable financial information for a number of different stocks. The data that will be analyzed is a stocks company information, their historical and current stock prices, earnings, balance sheet, cash flow, income statement, and several key statistical measures. A full accounting of this information will be provided in later sections. This information was chosen because it represents a wide array of information about any chosen stock. This information can be used to derive key financial ratios that will be used to make financial decisions for the investment club.

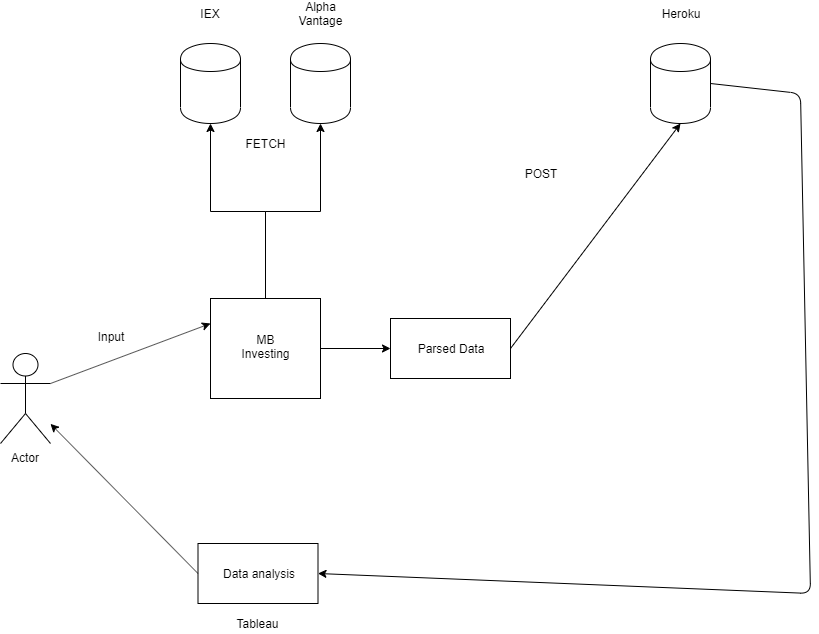

Architecture

At the highest level, api calls will be made to fetch the data at regular intervals. This data will be parsed and then stored into a heroku database. After this, it will be displayed in tableau where the members of the club will do financial analysis. Based on this analysis, graphs will be created to show users about a particular stocks performance. For example, one of these graphs could contain the top 10 stocks with high performing asset ratios.

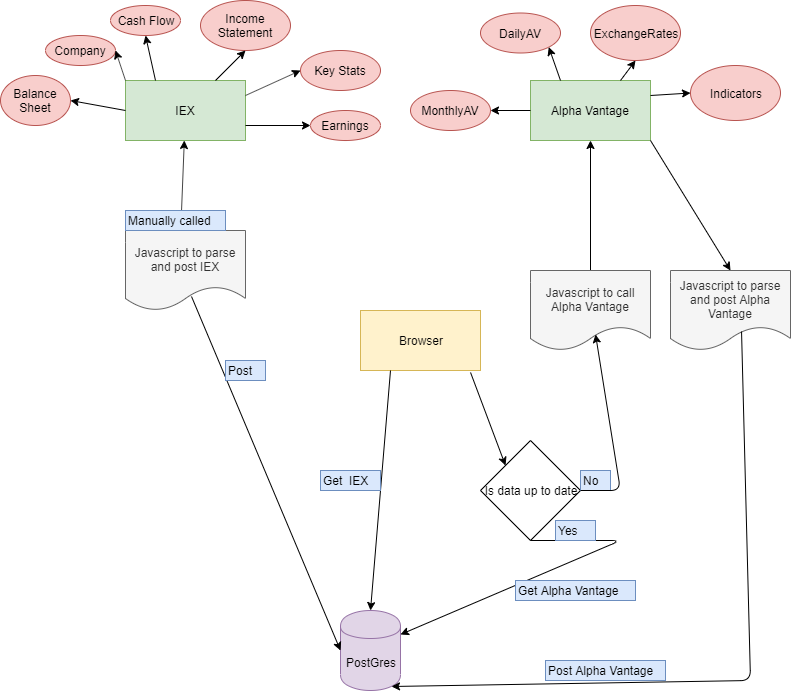

API Flow

The implementation of MB Investing involves making a node.js route in order to call two different third party servers, IEX and Alpha Vantage. These servers give detailed financial information about different stocks as well as performance indicators for them as well. The flow of this data through the site is shown in the diagram below.

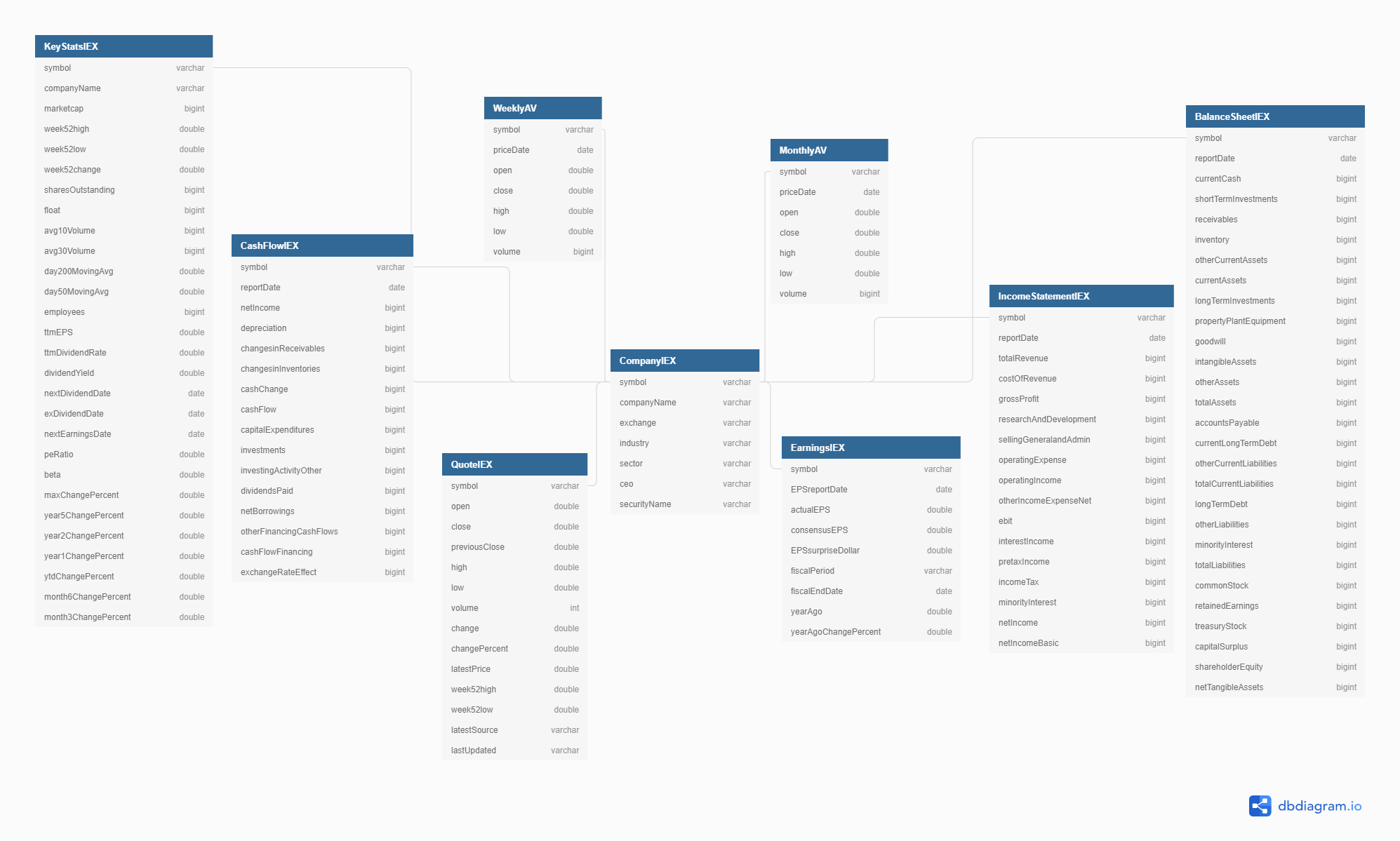

Database Diagram

This database diagram shows the focus of the project. All the data centers around the company table. This is because all the information shown relates to financial information about stocks. The information all ties in to the company table which has sector and industry tags to show a high level overview of markets, and it can be broken down further to show information about specific stocks.